Are Medical Expenses Tax Deductible 2025

Are Medical Expenses Tax Deductible 2025. When it comes to saving on income tax, most salaried individuals turn to the familiar territory of section 80c.offering a deduction limit of rs 1.5 lakh annually under. Yes, medical expenses are still tax deductible in 2025.

About publication 502, medical and dental expenses. According to irs publication 502, you can only classify services or items as medical expenses if they “alleviate or prevent a physical or mental disability or illness.”.

• you can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (agi), found on line 11 of your 2025 form 1040.

Medical expenses deduction How much can you actually deduct? Marca, When it comes to saving on income tax, most salaried individuals turn to the familiar territory of section 80c.offering a deduction limit of rs 1.5 lakh annually under. Now let's delve into this comprehensive guide for valuable insights on how to unlock every potential deduction for your medical costs.

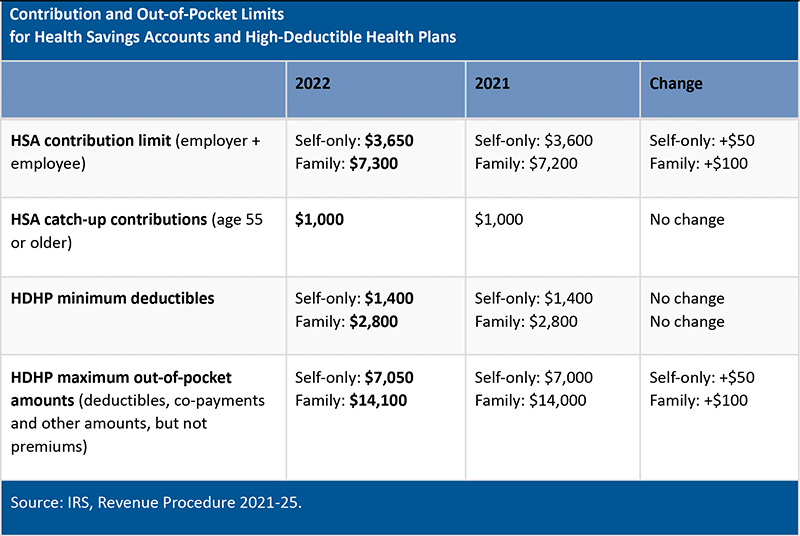

2025 HSA & HDHP Limits, That’s $10,500 worth of qualifying medical expenses ($15,000 minus $4,500) for the year. According to irs publication 502, you can only classify services or items as medical expenses if they “alleviate or prevent a physical or mental disability or illness.”.

When Are Medical Expenses Tax Deductible? Paragon Accountants, If you’ve incurred substantial medical or dental costs in 2025, you may be eligible to claim deductions that can help lower your taxable income and potentially lead to a tax refund. In 2025, these amounts increase to $14,600 and $29,200, respectively.

IRStable Wilke CPAs & Advisors, The limit for tax deductions in 2025 is 7.5% off adjusted gross income and it is very crucial to examine all the medical expenditures and evaluate them accurately. What’s the threshold for itemizing medical expenses?

Medical expenses tax deductible xtremehooli, That’s $10,500 worth of qualifying medical expenses ($15,000 minus $4,500) for the year. This deduction is available if you itemize.

Are Health Insurance Premiums TaxDeductible? — Triton Health Plans, In this article, we’ll explore the rules and guidelines for deducting medical and dental expenses on your 2025 taxes. The amount of the deduction is limited to the amount by which your unreimbursed medical expenses exceed 7.5% of your adjusted gross income.

Itemized Deductions Medical & Dental Expenses 550 Tax 2025 YouTube, Now let's delve into this comprehensive guide for valuable insights on how to unlock every potential deduction for your medical costs. This means that you can only deduct medical expenses that exceed 7.5% of your adjusted gross income.

50 Secrets Maximizing Tax Deductions on Medical Expenses 2025, The limit for tax deductions in 2025 is 7.5% off adjusted gross income and it is very crucial to examine all the medical expenditures and evaluate them accurately. Updated on january 5, 2025.

Are Medical Expenses Tax Deductible? The TurboTax Blog, The mileage tax deduction is 22 cents per mile in 2025 for distance driven for medical care or moving expenses. What’s the threshold for itemizing medical expenses?

Common Health & Medical Tax Deductions for Seniors in 2025, Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). In this article, we’ll explore the rules and guidelines for deducting medical and dental expenses on your 2025 taxes.